Those who try not to looks in order to matrimony finance

The average price of a marriage has actually ascending. The cost of wining and you can dinner two group and two kits off family members is sometimes a primary expense. Include formalwear, groups, herbs, favors and you will a great rehearsal dinner and you can keep an eye out on several thousand cash (or maybe more!). Certain people enjoys offers they may be able put to use or well-heeled parents that happen to be willing to help.

Relationship Funds: The basic principles

A marriage financing are a personal loan that’s created specifically to pay for relationship-related expenses. If you have already over specific wedding ceremony planning you will be aware that there’s a giant upwards-charges to possess whatever has the word wedding attached to they. A lower body-size light beverage skirt might cost $200, but a lower body-length white dress billed as a wedding dress? $800 or higher. An identical tend to goes for signature loans.

When you start debt consolidation loan looking around private funds it is possible to see that there are several lenders on the market, regarding traditional financial institutions so you can borrowing unions and you will fellow-to-fellow lending websites. All of these features large-interest-rates offerings. It is it best if you accept these money? Perhaps not.

All the loans try a danger. The better the speed, the better the chance. For individuals who need a marriage mortgage, you should not simply search for low interest rates. It’s a good idea to find fund having reasonable otherwise zero fees, plus no prepayment penalty.

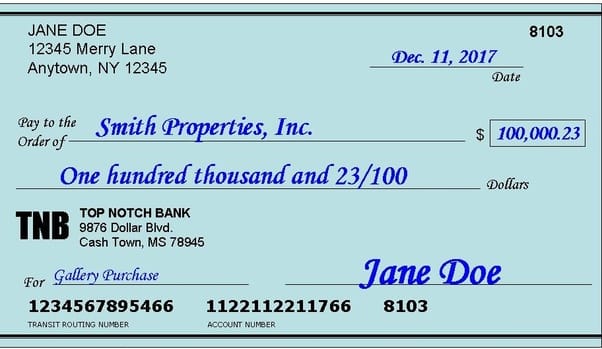

To try to get a marriage mortgage you will need to yield to a credit score assessment and you may look at the typical financing underwriting processes, because you create which have an everyday unsecured loan. The higher your borrowing, the lower the Apr (Apr) was. Your wedding loan also come with a loan name. The fresh terminology are usually doing three years however was given that much time as 84 months.

Naturally, some people choose charges wedding instructions on their handmade cards even though signature loans are apt to have lower interest rates than credit cards. Before you place your wedding costs to the vinyl, it would be a smart idea to discuss personal loan options. While up against monetaray hardship otherwise problems, you are in a position to qualify for a married relationship offer you to allows you to create your wedding goals become a reality.

Is actually Marriage Financing smart?

For folks who plus designed together with her has actually a few good, middle-to-large incomes, trying to repay a marriage mortgage may be simple. If your income would be the fact high, why-not hold off and you can conserve for the marriage? Consider what else you certainly can do on the money you’d expend on attract costs getting a marriage mortgage.

Without having the type of incomes who generate trying to repay a married relationship mortgage down, investing financing is financially unsafe. The same goes to have couples one to already carry a lot of personal debt. Had home financing, car and truck loans and you will/or figuratively speaking? In that case, it is best to think before you take into the significantly more debt.

Any sort of your position, its value investigating matrimony financing possibilities that wont make you in debt. Do you has actually a smaller sized, more modest matrimony? Do you really impede the wedding time to offer yourselves more time to store up? Nonetheless maybe not confident? Training point to a correlation ranging from high-costs wedding receptions and better splitting up prices. A moderate occasion will be the ideal thing for the lender levels and your matchmaking.

If you decide to remove a wedding loan you could potentially want to consider relationships insurance coverage. For some hundred bucks, a marriage insurance plan usually reimburse you when your place happens broke, a condition waits their nuptials otherwise your photographer seems to lose any photo. If you’re using financial risk of purchasing a marriage that have financing, this may add up to purchase yourself a small tranquility regarding brain that have a married relationship insurance plan.

It is advisable to search to make certain you may be having the best marketing into the both the loan in addition to insurance rates policy. Cost will vary commonly. Once you know you really have sometime before you will have to acquire the money, you could begin doing bumping up your credit rating. Look at the credit file getting mistakes, create on the-date costs and keep maintaining your own borrowing from the bank usage proportion within or below 30%.

Realization

We are inundated which have pictures away from high priced weddings within our culture. You can take-in the message your just relationships worthy of that have is certainly one you to definitely vacations the lending company. You might thought remaining some thing more compact (or perhaps within your budget). Odds are your wedding day is not necessarily the last larger expenses you’ll face given that two. Envision how do you pay money for property get, youngsters’ college tuition and you may advancing years if you get started the matrimony if you take toward an enormous chunk away from personal debt.